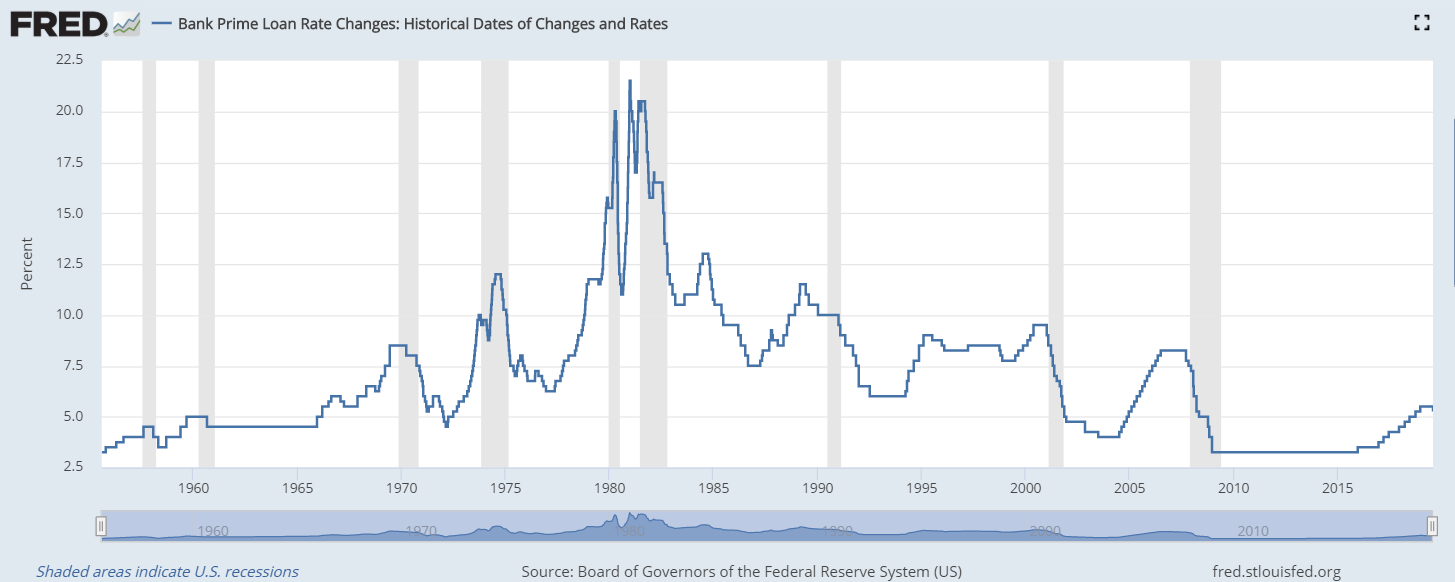

For example an adjustable rate mortgage may have an interest rate floor stating that the rate will not go below 3 5 even if the formula used to calculate the interest rate would have it do so.

Loan floor rate definition.

The dealer then receives payment hopefully including a profit and remits the balance to the lender who in turn releases the title to the car to the new purchaser.

Floor loans apply to buildings that will be occupied by tenants.

Floor planning is a type of inventory financing for large ticket retail items.

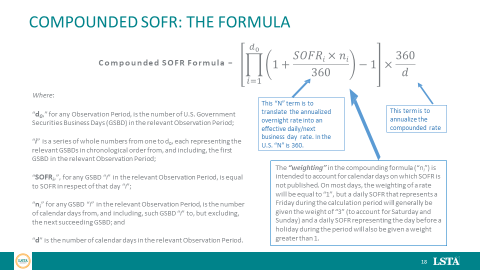

Interest rate floors are utilized in derivative contracts and loan.

The buyer of the floor receives money if on the maturity of any of the floorlets the reference rate is below the agreed strike priceof the floor.

Floor to ceiling loan.

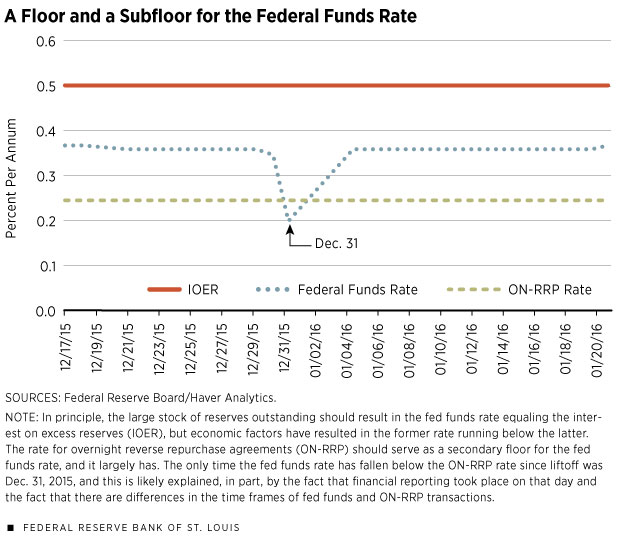

The floor however puts a lower limit of zero on the floating rate of the loan so there are no receivables from the loan illustrated below.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

In this type of loan there are two separate funding amount.

In a negative interest rate environment a swap does not offset the interest rate risk in a floating rate loan when a floor of zero is included in the loan documentation.

Interest rate floors are utilized in derivative contracts and loan.

When assessing your ability to afford your home loan repayments or serviceability most lenders will also add an extra buffer known as a benchmark assessment rate or floor rate.

This will typically be 2 3 above the bank s svr and it s applied when assessing a customer s income and asset position for serviceability.

Interest rate floor the minimum interest rate that may be charged on a contract or agreement.

Floor plan financing is also done for large appliances mobile homes and boats among other items and these products are usually sold to consumers with a financing contract.

The floor loan is the minimum.

2 interest rate floors are an agreed upon rate in the lower range of rates associated with a floating rate loan product.

The interest rate floor is the lowest interest rate the lender can offer you to adjustable sometimes called variable rate mortgage.

A word floor is used for more financial terms in financial area and means minimum e g.

The related term is a floor to ceiling loan.

Retailers use a short term loan to purchase inventory items and the loan is repaid as inventory is sold.

A floor loan is a specific kind of loan designed specifically for real estate construction projects.

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

/GettyImages-508210587-035f69f0bb23424287d09c3a93bf4735.jpg)

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

:max_bytes(150000):strip_icc()/GettyImages-522209078-3d1fee1a84a64894bc6a3718ec2a5499.jpg)